Yes to Currency Equity

No matter where you are,

you never have enough

W ithin a few months of the end of the Tour, the house of cards that is the global financial system began to show the first signs of its inevitable disintegration. As I was planning the Tour, I began to hypothesize that such a system failure might actually begin while I was away, which could have adversely effected my accounts held in US Dollars, and, consequently, disrupted my ability to continue the Tour. As it turned out, it seems that I had simply been a small number of years too early in expecting such a state of affairs, which, at least, allowed me to complete the Tour without major problems. As I write this, however, no one knows for sure if the major monetary systems of the world are entering a long period of deflation, hyperinflation, or some other phenomenon. Either of those possibilities would certainly affect one's multi-year tour in unpredictable ways, and future tourists would do themselves a favor by considering the possibilities. I understand, now more than ever, that in a world of global communications and generally open borders, the disjointed system of currencies that we find ourselves stuck with, for the moment at least, is fundamentally flawed.

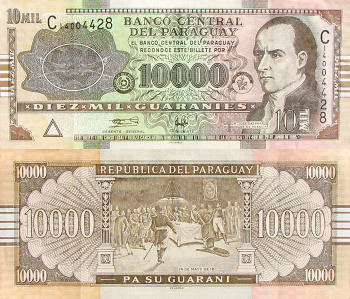

The one pleasing aspect of the current system is seeing the myriad designs and patterns used on the various currencies of the World. I especially like how many countries proudly display their unique wildlife, art, or cultural heritage on their banknotes. Mayan pyramids on Guatemalan Quetzals, lemurs on Madagascar Ariaries, or birds of paradise on Papua New Guinea Kinas, seem to make spending lots of cash a little more palatable, at least for me. Some of the more attractive examples of the forty-one currencies I used during the Tour are shown on this page.

A 10 Kina note from Papua New Guinea

A 50 Kyat note from Myanmar

Just Give Me the New Kind, Please

The downside of this is that it often seemed like I was spending as much time exchanging money as I was cycling. That may be a bit of an exaggeration, especially in places like Australia, where one flavor of currency would be usable for many months. On the other hand, that is close to true in places where one changes countries frequently, such as Central America or Southeast Asia. I knew that exchanges were simply something that I needed to deal with, but I did not expect the process to be so often fraught with annoyances and, occasionally, such a money-loser. Indian moneychangers would not exchange Nepali Rupees, due to counterfeit concerns. Their Sri Lankan counterparts would take Indian Rupees, except for 1,000 Rupee notes, which were the usually the only denomination that Indian banks handed out. In Myanmar, it was well known that the "official" exchange rate was less than the rate on the street. However, I assumed that the difference would be a few percent, at most. I was lucky that the government moneychangers at the Yangon airport were kindly people, as they talked me out of exchanging a large amount of cash there. Later on, I learned that the street rate was 50%, or more, above that rate at the airport.

When crossing from Malawi into Zambia I debated on which side of the border I should exchange my cash, and chose to do it on the Malawian side. One hundred meters father, across the border, the independent money exchange brokers I met would have given me 25% more. At the next border, Zambia into Botswana, I thought that I had learned my lesson, and waited until I got across. Of course, in the Botswanan border town of Kasane none of the Bureaus of Exchange would accept Zambian Kwachas, as they considered it to be trivial, almost worthless, paper. In Madagascar, I was forced to try four or five different exchange places before I found one that would exchange South African Rands, despite Johannesburg being one of only a few departure points for flights into that country. Back in South Africa, banks often insisted on seeing proof of where one's Rands were obtained before exchanging them for Dollars, or other notes.

Then there was the bizarre case of Zimbabwe, which could provide a bit of foreshadowing for the future for other major countries. I had, long before, decided not to include that country on my route due to its political problems. However, when visiting Victoria Falls, located on the Zambian-Zimbabwean border, I discovered that during the dry season there is no actual water that can be seen going over the falls from the Zambian side. That meant I needed to make a brief visit to Zimbabwe in order to appreciate the true magnificence of the falls. The required visa could be paid for with Zambian Kwachas but I was told by an unscrupulous scam artist at the entrance to the National Park that the entrance fee needed to be paid in Zimbabwean Dollars. At that time, in 02006, Zimbabwe's hyperinflation was still in its early stages. The exchange rate when I started the Tour was around 300,000 Zim Dollars for one US Dollar. However, a few months earlier, the government struck three zeroes off their notes, devaluing it by a factor of a thousand, and so the 300:1 rate didn't seem too bad.

So I exchanged some notes to Zim Dollars, but, of course, the park wouldn't take them after all. Unfortunately, my remaining cache of US Dollars was a few short of the $30 entrance fee. However, the obviously understanding, and exasperated, ticket collector let me go in anyway. I insisted that she take the Zim Dollars I had in order to make up the difference, but I could tell that she didn’t really want them. While I was riding the last two Stages of the Tour, Zimbabwe's hyperinflation really took hold, and I watched the exchange rate pass one million to one; then a billion; then hundreds of billions; and on to trillions. The very thought of carrying around huge stacks of million-dollar notes in order to buy daily meals should send shivers down the spine of all weight-conscious tourists out there.

A 10 Ngultrum note from Bhutan

A 10 Birr note from Ethiopia

Practicalities

Another potential pitfall is to allow oneself to become arithmetically complacent in regions with disparate currency values. An example would be in Southeast Asia. There, a meal in Laos might cost 100,000 Kip, and a decent hotel 300,000. After crossing the border into Thailand, where one US Dollar bought around forty Bhat, a nice meal costing 1,000 Baht might seem to be a good value, but, in reality, it is two and a half times the price. Time is usually required to adjust one's thinking to the value of a new currency in order to avoid spending too extravagantly. However, the frequency that one changes countries can often make that a real challenge.

A 100 Franc note from Rwanda

A 1000 Ariary note from Madagascar

It may seem that carrying a large supply of US Dollars or Euros would be a good idea, to help steer clear of some of the issues mentioned above. However, on a tour of forty months that is obviously quite impractical, not to mention very risky. I was a little surprised that I encountered travelers, from time to time, who still carried Traveler's Checks as their main source of funds. Today, that seems to me to be a method straight out of the Stone Age. The only thing that would appear to be more troublesome than currency exchange would be finding a place to cash those annoying checks. I much preferred to depend on ATMs for restocking my cash supply. In general that worked reasonably well during the Tour.

However, I can provide a few tips for other travelers in that regard. Try to carry two cards, from two different banks, preferably on two different networks (Cirrus/Plus/Star, etc.,) and be sure at least one has the VISA logo on the front. In doing that, I never had any problems (apart form one monumental screw-up caused by a bank.) There were only a handful of countries I visited where international ATMs were absent, at least outside the capital cites; Papua New Guinea; Timor Leste; Laos; Myanmar; Bhutan; and Ethiopia. Coverage is changing rapidly however, so by now even some of those countries may have installed some in their major towns. During my first tour in Madagascar in 02003, there were none in the entire country, but upon my return in 02006, most major towns had at least one. Only a few countries had other issues; Argentina allowed only annoyingly small withdrawals per transaction, possibly a result of their economic crisis in the early '00s; Brazil had plenty of ATMs, but frequently only one out of ten was connected to the international networks, and that was usually the one that was out of service.

Many travelers fret endlessly on finding exactly where to receive the best exchange rates, but as someone who had a need to keep moving, I could rarely be bothered by such time consuming tasks. It is generally assumed that withdrawing local currency at ATMs will give one about the best rate possible. While there are often annoyingly high fees for doing so, they are comparable, or perhaps less, than the cost of cashing traveler's checks, or the value lost in exchanging local currency. With these factors in mind, my policy, which I can recommend to all travelers, at least in the current financial regime, was to withdraw local currency from ATMs in as large an amount as allowed, to minimize transaction fees, and to try to spend most of it before crossing the next border, to minimize the amount needed to be exchanged.

The Real Issue

I typically did not waste many thoughts worrying about any of the issues mentioned above. One thing that did concern me, however, was the gross inequities built into the current collection of global currencies. For someone born where I was, this is more of a philosophical, or moral, issue rather than a practical one, but one that I would, nevertheless, like to see straightened out. Part of the problem has been around since the divide between the "First World" and the "Third World" was originally formed. An additional component has been created by various countries that have tried to solve their financial problems by printing money out of thin air. The result has grossly skewed the value of goods and services in various parts of the World. I have always been a firm believer in the principal of equal pay for equal work, and I extend that to equal price for equal value as well. When it comes right down to it, there is no logical reason why a hotel room in Phrae, Thailand should cost much less than its otherwise equivalent counterpart in Flagstaff, Arizona. The same can be said for comparable meals, handicrafts, labor, and many other items, though it is frequently not the case in reality.

Many will argue that these price differences are caused by the lower cost of living in various places, but this is not based in any sound logic that I can see. For it is the same inequity in currency values which, in large part, causes the cost of living to be much lower in such places in the first place. To compare the situation another way; saying that a local cook can buy their daily needs with the proceeds from three-dollar restaurant meal they just prepared for me is a very Consumerist point of view, whereas I much prefer to take a Productionist approach. In that regard, the price of a product should be based on its value to me, independent of where it was produced. Therefore, a nice meal in India, Australia, or Honduras, should be priced equally, as they are of equal importance to me.

A 10000 Guarani note from Paraguay

A 2000 Peso note from Colombia

I realize that I am perilously close to offending the sensibilities of a major segment of the wandering population; namely, the Budget Travelers. Their world has now become a mainstream industry, and there are numerous guidebooks available purporting to reveal those secret places where someone can travel virtually for free. Make no mistake, there were days when my daily expenses added up to a handful of dollars, and on such days I never complained. That does not mean that I approved of the nature of the situation overall, however. Within reason, being frugal and conserving one's resources is a wise behavior. However, I observed too many tourists who sought to game their cultural advantage by taking such actions to an extreme level, and too many who constantly celebrated any occasion where they received something at essentially no cost.

In Mandalay, Mynamar, a young Australian man became incensed when he was charged the equivalent of one US Dollar for an hour of internet access even though he only used fifty minutes, and proceeded to harangue the proprietor that he should be given ten free minutes the next day. Never mind the facts that buying a computer and establishing 'Net service in that oppressed country is next to impossible and that shop owner could use all the help he could get, or that I, myself, had been charged fifteen Australian Dollars for two hours of access in Camoweal, Australia, not long before. Later, in Com, Timor Leste, one of the "poorest" places you're likely to see, an otherwise pleasant French tourist launched an annoying lecture towards the owner of the very basic guesthouse there, claiming that the three-Dollar dinner he had just been served would only have cost one Dollar in Vietnam.

On one pleasant evening in Monkey Bay, Malawi, I found myself chatting late into the night with a traveler from Chile, and another from Hong Kong. Eventually, the conversation drifted to the typical arts and crafts that are for sale almost everywhere in Africa. The Chilean man insisted that no one should ever pay more than two Dollars for one of the omnipresent bookshelf-sized wooden animal carvings. When I expressed my view that it probably took someone at least two days to make one of those items, no one seemed to be bothered that someone's effort was only worth one dollar per day. In my opinion, traveling involves giving back to, as well as receiving from, the places one visits, and that is much harder to do when the deck has been stacked against many parts of the World. It is no wonder that several tour operators and guides revealed to me that they often have to hide the disdain they feel for some of their own customers.

A 20 Cordoba note from Nicaragua

A 2 Dollar note from Belize

Can This Improve?

For any of this to change, a worldwide readjustment of the current monetary system would seem to be in order. Of course, we can expect fierce opposition from those segments of society that today feel they have an advantage over others. Perhaps the shudders currently running though the financial world are the precursors of such a realignment happening independently of any concerted action on the part of the financial powers. If so, it would be nice if global equity were to be purposely built into whatever system emerges next. If anyone were to ask me what I think that system should be, which, of course, is not very likely, my response would be that it should involve introducing a universal currency throughout the world, which would not be based on fantasy, as our current currency is, nor backed by precious metals, as the currencies of the past had been, but rather on units of energy. That, however, is a subject best left for a future discussion.

Previous | Next

Main Index | Pre-Tour Index

Post-Tour Index | Articles Index

Slideshows

Main Index Pre-Tour Post-Tour Articles Previous Next |

Currencies of

the Tour

These are the exchanges rates for the currencies of the various countries of the Tour, as they were at the beginning of each Stage. One United States Dollar was equivalent to the amount listed of each currency.

Timor Leste, Ecuador, and Panama used US Dollars as their official currency.

Cambodia and Myanmar used US Dollars as alternate currencies.

Bhutan used Indian Rupees as an alternate currency

Swaziland and Lesotho used South African Rands as alternate currencies.

One US Dollar equals:

Europe

0.77 Euro

Australia

1.28 Dollars

Singapore

1.64 Dollars

Belize

1.97 Dollars

Brazil

2.10 Reals

Argentina

3.02 Pesos

Papua New Guinea

3.07 Kinas

Peru

3.14 Nueva Sols

Malaysia

3.80 Ringgit

Egypt

5.60 Pounds

Myanmar *

5.61 Kyats

Botswana

5.88 Pulas

Lesotho

7.01 Lotis

Swaziland

7.01 Emalangenis

South Africa

7.01 Rands

Guatemala

7.58 Quetzals

Bolivia

7.64 Bolivars

Tibet

8.28 Chinese Yuans

Ethiopia

8.50 Birrs

Mexico

11.03 Pesos

Honduras

18.88 Lempiras

Nicaragua

20.15 Cordobas

Uruguay

23.98 Pesos

Thailand

39.54 Bhats

Bhutan

43.52 Ngultrums

India

43.54 Rupees

Bangladesh

62.48 Takas

Kenya

65.48 Shillings

Nepal

72.06 Rupees

Sri Lanka

99.78 Rupees

Malawi

122.22 Kwachas

Costa Rica

472.05 Colones

Chile

527.15 Pesos

Rwanda

540.09 Francs

Burundi

959.20 Francs

Tanzania

1,222 Shillings

Madagascar

2,111 Ariarys

Colombia

2,202 Pesos

Zambia

3,475 Kwachas

Cambodia

4,067 Riels

Paraguay

5,081 Guaranies

Laos

10,076 Kips

* This was the "Official" rate, the actual street rate was much higher.